How To Begin Investing With $100 Or Much less

Do you know you can begin investing with $100 or much less? Most individuals suppose that you just want hundreds of {dollars} to get began investing, however that is merely not true. In truth, I began investing with simply $100 once I began working my first job in highschool (sure highschool).

It is attainable to begin investing in highschool, or in faculty, and even in your 20s.

Much more meals for thought – should you invested $100 in Apple inventory in 2000, it could be value $25,000 at this time. Or should you invested in Amazon inventory at that very same time, it could be work over $3,500 at this time. And that is simply should you invested $100 as soon as.

Think about should you invested $100 month-to-month since 2000 in Apple inventory? You’d have effectively over $4,000,000 at this time. Critically.

Hopefully that is fairly motivating for you, and proves that you do not want some huge cash to begin investing. Simply try this chart:

Bear in mind, essentially the most tough a part of beginning to make investments is just getting began. Simply since you’re beginning with $100 does not imply it is best to wait. Begin investing now!

Let’s break down precisely how one can begin investing with simply $100.

The place To Begin Investing With Simply $100

If you wish to get began investing, the very very first thing you need to do is open an investing account and a brokerage agency. Do not let that scare you – brokers are similar to banks, besides they concentrate on holding investments. We even keep a listing of the very best brokerage accounts, together with the place to seek out the bottom charges and greatest incentives: Finest On-line Inventory Brokers.

Given that you just’re solely beginning with $50 or $100, you’ll want to open an account with zero or low account minimums, and low charges. Our favourite brokerage for beginning out is Charles Schwab. The explanation? $0 commissions, and you’ll spend money on nearly every little thing you need – totally free!

Bear in mind, some brokers cost $5-20 to put an funding (known as a fee), so should you do not select an account with low prices, you can see 5-20% of your first funding disappear to prices. Or different locations (like Acorns or Stash) cost month-to-month charges – as much as $9 per thirty days! In the event you solely have $100 – you can be at $0 in a short time simply paying charges.

There are additionally different locations you can make investments totally free. This is a listing of the very best locations to speculate totally free. Simply keep in mind, many of those locations have “strings connected”, the place you will need to spend money on their funds, or spend money on an IRA, to speculate totally free.

Backside Line: Decide a low value dealer like Constancy or Charles Schwab. You may be happiest in the long term.

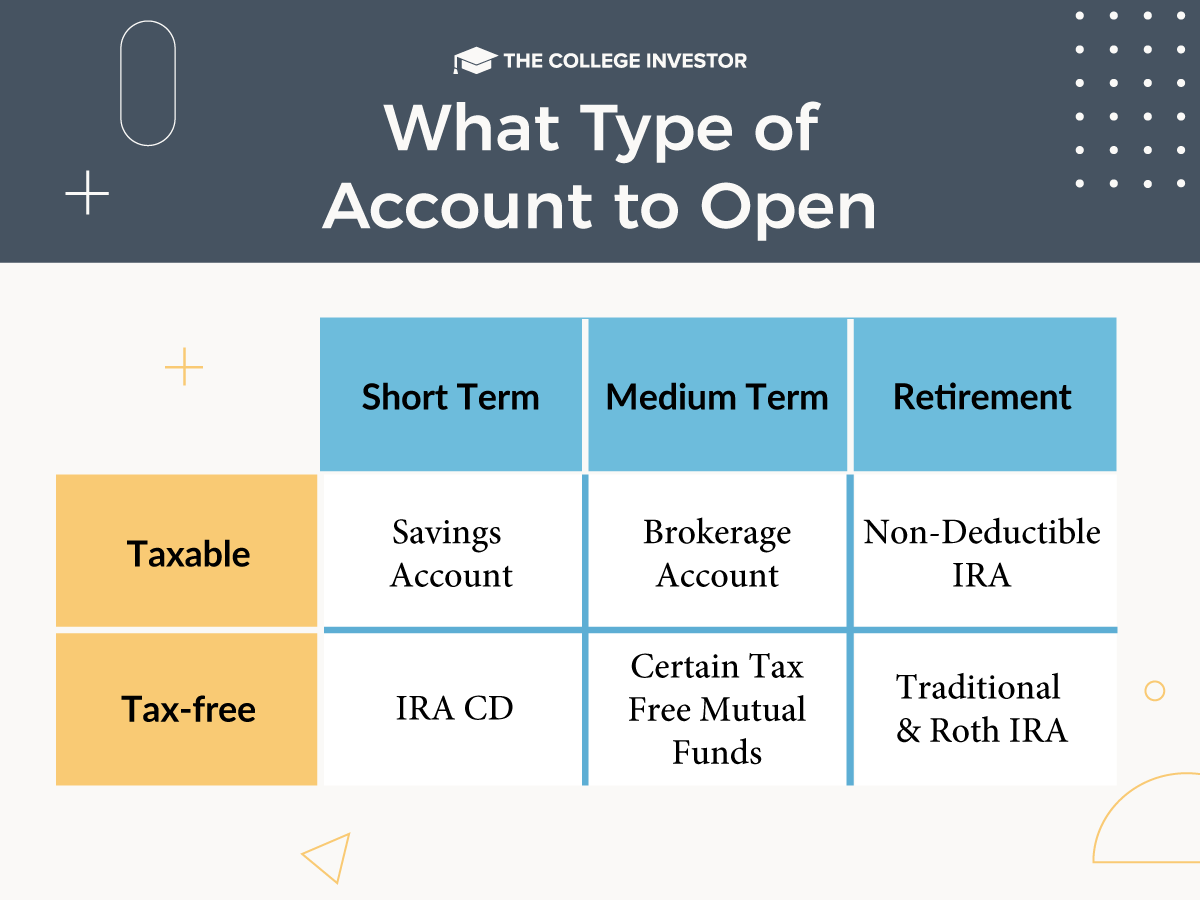

What Sort Of Account Ought to You Open

The following determination you need to make is what sort of funding account to open. There are lots of completely different account varieties, so it actually will depend on why you are investing. In the event you’re investing for the long run, it is best to concentrate on retirement accounts. In the event you’re investing for the shorter time period, it is best to preserve your cash in taxable accounts.

This is a chart to assist make sense of this:

Most individuals will wish to have each an IRA and a taxable brokerage account. However you can begin with one.

Associated: Order Of Operation For Saving and Investing

How To Make investments $100 (What To Really Make investments In)

The following problem is what to spend money on. $100 can develop lots over time, however provided that you make investments properly. In the event you gamble on a inventory, you can lose all of your cash. And that will be a horrible option to begin investing. Nonetheless, it is very uncommon to lose all of your cash investing.

To get began, it is best to concentrate on investing in a low value index-focused ETF. Wow, that appears like a mouth-full. But it surely’s fairly easy actually. ETFs are simply baskets of shares that comply with a sure index – they usually make lots of sense for buyers simply beginning out. Over time, ETFs are the bottom value methods to spend money on the broad inventory market, and since most buyers can not beat the market, it is sensible to only mimic it.

For instance, the S&P 500 is a standard index – it is the most important 500 firms in the US. If considered one of them fails (goes bankrupt), firm 501 slots into the index. It is what gives security and diversification. And for development, so long as the nation is rising, the index also needs to develop over the long term.

Take a look at this information on the right way to spend money on the S&P 500 for concepts.

If you do not know the place to begin, we have put collectively an important useful resource within the Faculty Pupil’s Information To Investing, the place we break down a number of completely different ETF selections to construct a starter portfolio.

Take into account Utilizing A Robo-Advisor

In the event you’re nonetheless undecided about what to spend money on, take into account utilizing a robo-advisor like Wealthfront. Wealthfront is a web based service that may deal with all of the “investing stuff” for you. All you need to do is deposit your cash (and there may be $0 minimal to open an account), and Wealthfront takes care of the remaining.

If you first open an account, you reply a sequence of questions in order that Wealthfront will get to know you. It would then create and keep a portfolio based mostly on what your wants are from that questionnaire. Therefore, robo-advisor. It is like a monetary advisor managing your cash, however the pc takes care of it.

There’s a price to make use of Wealthfront (and comparable companies). Wealthfront costs 0.25% of the account stability. That is possible cheaper than what you’d pay a conventional monetary advisor, particularly should you’re solely getting began with $100. In truth, virtually all monetary advisors would most likely refuse that can assist you with simply $100.

So, if you would like a system that can assist you make investments, try Wealthfront right here.

Associated: Discover out our picks for the very best robo-advisors right here.

Alternate options to Investing In Shares

In the event you’re undecided about getting began investing straight away with simply $100, there are alternate options. Bear in mind, investing merely means placing your cash to be just right for you. There are lots of methods to make that occur.

Listed here are a few of our favourite alternate options to investing in shares for simply $100.

Financial savings Account Or Cash Market

Financial savings accounts and cash market accounts are secure investments – they’re usually insured by the FDIC and are held at a financial institution.

These accounts earn curiosity – so they’re an funding. Nonetheless, that curiosity is usually lower than you’d earn investing over the identical time period.

Nonetheless, you’ll be able to’t lose cash in a financial savings account or cash market – so you will have that going for you.

The greatest financial savings accounts earn upwards of 5.00% curiosity at the moment – which is the best it has been in years!

Funding Choices To Keep away from

There are two funding choices which might be pitched on a regular basis that we advocate you keep away from.

Subscription Investing Apps

There are a number of firms on the market that publicize getting began investing for simply $5. We wish to just remember to have a “purchaser beware” mindset in the case of utilizing these firms and also you absolutely perceive what you are entering into.

For instance, Stash Investing permits you to make investments for as little as $5. Nonetheless, they cost a $1 per thirty days price on accounts of lower than $5,000. In the event you’re solely investing $5 per thirty days – and paying $1 in charges every month, your portfolio return goes to undergo (and even lose) cash.

In the event you solely make investments $5 per thirty days for a yr, you will have dedicated $60. Nonetheless, you will have paid $12 in charges – leaving you with $48. That is 20% of your cash being given as much as charges.

Solely in 32 of the final 100 years has the inventory market returned over 20% in a given yr (and that yr normally adopted a extremely dangerous yr). The common return has been roughly 11%.

That is why you’ll want to keep away from companies that cost you large charges to speculate. $1 per thirty days won’t appear large, however it’s as a share of your $100 funding.

Compound Curiosity Accounts/Insurance coverage Merchandise

In the event you’ve been on social media within the final a number of years, there have been lots of people pitching “compound curiosity accounts” or different variations on life insurance coverage merchandise which might be offered as investments.

Please do not “make investments” or purchase into these listed common life insurance coverage insurance policies. They might have horny names, and are pitched by actually convincing gross sales folks, however the backside line is that these merchandise are costly (lot’s of charges), they usually usually underperform the inventory market. You may come out approach behind in 20 years should you make the most of these merchandise – and that is assuming that you do not miss a cost and lose the coverage.

Simply keep away from this stuff!

Simply Get Begin Investing

Bear in mind, the rationale why you are investing is to develop your cash over the long run. Which means you are leveraging the facility of time and compound curiosity.

Time works in your facet. The sooner you begin investing, the higher. So, even should you solely have $100 to speculate, simply get began.

The post How To Begin Investing With $100 Or Much less appeared first on Nakedlydressed.

How To Begin Investing With $100 Or Much less published first on https://www.nakedlydressed.com/

Comments

Post a Comment